If you use Docusign or one of the other pdf online signing services, any document you’ve had signed electronically may be invalid. Before panicking, a lot will depend on how the signature has been created on those services. Equally, it may also depend on whether or not you’ve verified the signature yourself.

I was more than interested to read the case history of BIZCAP AU PTY LTD v SHARMA [2024] WASC 198 (14 May 2024). Why? It is the first instance I am aware of where a purported electronic signature has been contested. You can view the judgement here. In the end, the Court ruled a replacement caveat allegedly signed by the first respondent was invalid.

The facts

- The respondent used Docusign to sign a loan agreement with JVA (WA) Pty Ltd, trading as Skin Rejuvenate Cosmetic Clinic (“JVA”). The loan was secured by a caveat over any real or personal property held by the respondent and her co-director husband.

- At the time agreement was entered into, it was not in dispute that the first respondent was a co-director of JVA. The signature of the first respondent that appears on the copy of the Agreement relied upon by the applicant had been signed electronically through the use of Docusign. The Agreement records her email address as ankjshar@gmail.com.

- On 22 January 2024, a caveat was lodged over the property by Bizcap AU Pty Ltd (“Bizcap”), the grounds for which refer to a mortgage dated 30 June 2023.

- Bizcap lodged a replacement caveat on 2 April, allegedly signed by the first respondent.

- Aside from legal argument as to whether the replacement caveat was valid or not, the first respondent denied that she had ever had the email address recorded in the Agreement. As a director of JVA, she used a business email address of `info@skinrejuventate.com.au`. This email address was used by her in approving, authorising and signing other business loans of the Company.

The Court`s consideration in regard to the purported signature

Section 10 of the Electronic Transactions Act 2011 (WA) (“ETAWA”) sets out the requirements for a valid electronic signature under the laws of Western Australia. The Electronic Transactions Act 1999 (Cth) (“ETACth)”) does not apply in this instance because the loan was not a regulated contract under the National Consumer Credit Protection Act 2009 (Cth). The ETACth only applies to Commonwealth laws and as this loan was unregulated, the State-based legislation applies.

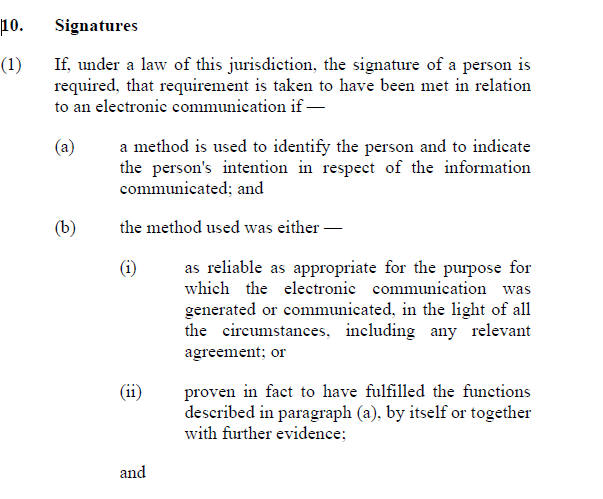

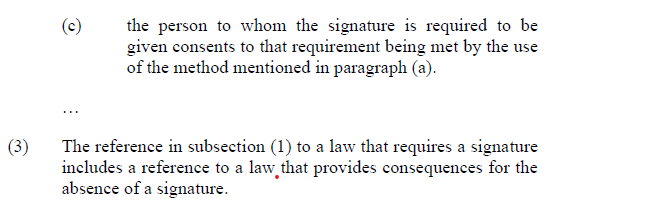

Under s.10 of the ETAWA, it provides that:

Hill J. stated that ” Having regard to the affidavit evidence before me, I consider there is sufficient doubt as to whether the first respondent electronically signed the Agreement. In addition to the matters raised by the first respondent, I note that the signatures of the first respondent and another guarantee appear to be in the same handwriting and the ‘signatures’ simply handwrite the relevant person’s name as opposed to being a signature. It also appears, in respect of the first respondent’s signature, the document was initially signed as ‘Anita’ and a ‘k’ has been added afterwards. I also take account of the fact that the applicant has not adduced any evidence as to the method it used to identify the first respondent, or the matters on which it relies as being the indications that the first respondent intended to sign the guarantee. Those matters are important given the method used has to be as reliable in light of the circumstances, including the relevant agreement. In this case, the agreement is a guarantee under which the guarantors agree to secure all real property.”

“It is my view that some steps should have been taken by the applicant to verify that the first respondent’s electronic signature was applied with her consent. There is no evidence before me that this is the case. In these circumstances, I am not satisfied the applicant has discharged its onus to demonstrate there is a sufficient likelihood of success in its claim of an equitable estate that would justify the continuation of the Caveat.”

Online PDF digital signing services – so are they valid?

Docusign, like other similar companies offering this type of service, do not ask for and obtain actual physical identification themselves. These services essentially offer two options:

- an option to provide an image of an individual’s written signature that could be compared to other identity verification documentation issued by Government. For example, a Passport or Driver’s Licence; or

- the individual can elect to provide their ‘signature’ by typing their name in either a standard typeface font or a hand-writing style font. Examples of these fonts are primarily typically script styles and there are any number of ones available in a wide variety of styles. These include casual handwriting or allegedly authentic (they haven’t seen mine!) to ones ‘written’ with a ball-point pen such as Biro Script.

As a result of this judgment, I went looking to see if I could any more and found yet another more recent case. In PROSPA ADVANCE PTY LTD v. TASOU [2024] WASC 359 (2 October 2024), see here, a similar situation of another disputed caveat document allegedly signed via Docusign was put before Whitby J. The Court came to the same conclusion. Whitby J said “it is my view that on the current evidence before the Court, there is no substance to the plaintiff’s claim that the first defendant signed the Agreement.” Reading the judgment, this was entirely based on the reasoning by Hill J in the BIZCAP AU PTY Ltd v SHARMA case.

I believe we’ll see more instances of this occurring. All the States have identical wording in their legislation. Please don’t think this is confined to Western Australia.

What does this mean?

These two cases have important concerns for any company that relies on electronic signatures. For example, I sign my tax return and accounting information electronically. Whilst this is done using an online PDF digital signing services, I upload an image. I don’t ‘sign’ it by merely typing my name but I have the ability to do so. Were I to do so, I don’t think it would stack up unless the accountants contact me and verify it was me ‘signing’ it. Without some other means of verifying that the signature does represent the party or parties involved, the Courts might not accept them.

Where to from here?

You may not be protected as much as you thought. If you’re an entity that uses, accepts and relies on electronic signatures for legal reasons, you might want to seek proper legal advice as soon as possible to see if and how this decision affects you. It is likely it will not affect all electronic signatures provided by these pdf online digital signature suppliers but you may have to modify your acceptance processes for at least one of the methodologies they offer.